Our old friend, the mortgage rate — when it’s low, it’s helping you get more house for your money. Sounds fantastic, right? Mortgage rates are just one of several factors that impact how much you can afford if you’re buying a home. As I am sure you heard, within the last year, mortgage rates hit the lowest point ever recorded (cue a flurry of housing market activity), and since then they’ve continued to hover in the historic-low territory. Alas, all good things must come to an end, friends! Over the past few weeks, rates have started to rise — most recently, the average 30-year fixed rate was 3.14%.

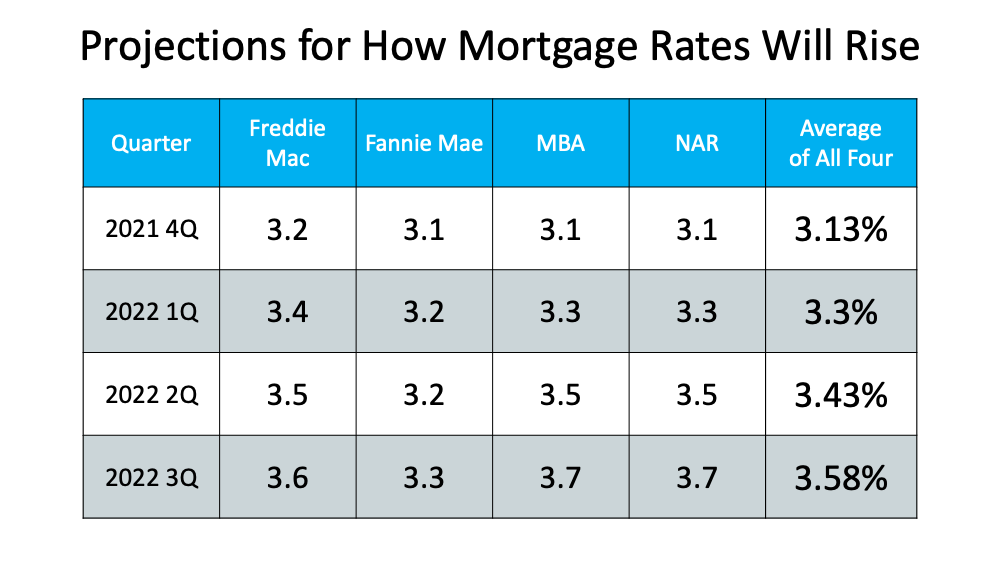

While this is good to know, let’s talk about what this means for you. If you are thinking of buying a home, the most important takeaway — waiting until next year will cost you more in the long run. Experts are projecting that mortgage rates may rise as much as 3.7% by the end of 2022.

Though rates may not reach that number, even If they rise a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the (oh too harsh) reality is, as prices and mortgage rates rise, it will cost more to purchase a home.

Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s home buying affordability. That could be just the game-changer you need to achieve your homeownership goals.

Bottom Line

If you’re thinking of buying or selling over the next year, it may be wise to make your move sooner rather than later – before mortgage rates climb higher.

Anytime between “now” and “right now” is a good time to take action on shaping your best life, and that includes where you live. Let’s get the ball rolling on your next steps.

(702) 374-6807. Or drop me a line here.