Let’s be real—life loves to throw us curveballs. Whether it’s an unexpected job loss, surprise medical bills, or a natural disaster, sometimes those curveballs hit right in the wallet. If you’re a homeowner feeling the pinch, don’t worry—there’s help! Mortgage forbearance could be just the lifeline you need to navigate tough times.

So, What’s Mortgage Forbearance, Anyway?

Think of mortgage forbearance as hitting the “pause” button on your payments or dialing them down for a bit. According to Bankrate, forbearance is an option for borrowers to utilize during a short-term crisis.

A lot of folks think forbearance was a pandemic-only thing. Not true! It’s still a handy option for homeowners in a jam. It’s designed to help you weather the storm without sinking into delinquency or, worse, foreclosure.

Is Mortgage Forbearance a Big Thing Right Now?

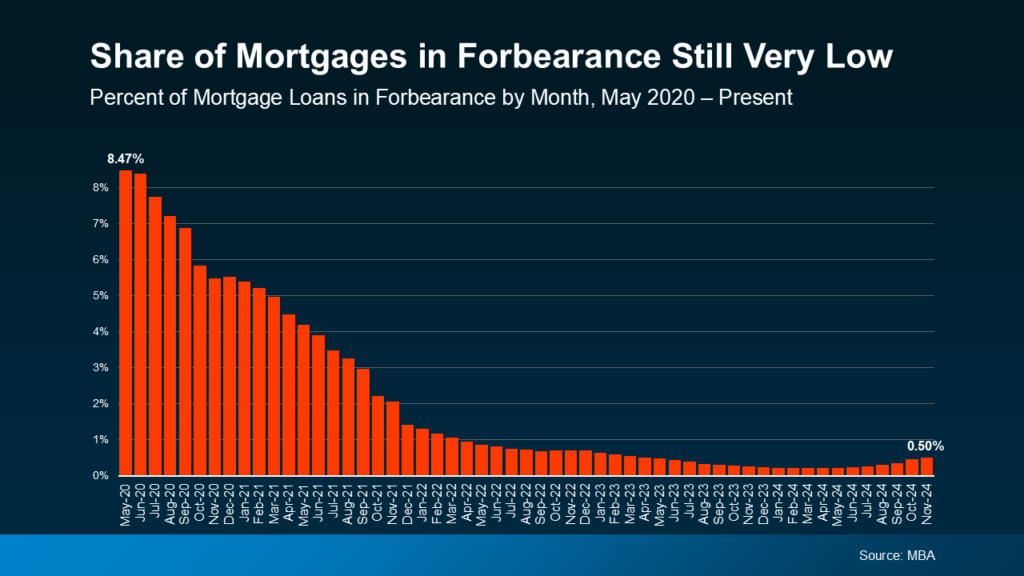

It’s not as common as during the height of the pandemic, but it’s still making waves. According to the Mortgage Bankers Association, the rate of forbearance ticked up slightly in the past six months.

Before you hit the panic button, let’s zoom out. The increase is tied mainly to natural disasters like Hurricanes and now the Los Angeles Fires. In fact, 46% of borrowers currently in forbearance say natural disasters caused their financial struggles.

Even with this small uptick, the number of homeowners needing forbearance is a fraction of what it was in 2020. That means most homeowners are on solid ground, thanks to strong home equity and a stable market.

Why Should You Care About Forbearance?

Forbearance can be a total lifesaver. Here’s why:

- It Buys You Time: You’ll get the breathing room to handle your finances without stressing about losing your home.

- It’s Tailored to You: Forbearance isn’t one-size-fits-all. Your lender can work out a plan that fits your situation.

- It Keeps Foreclosure at Bay: You’ll have the chance to recover without drastic consequences.

What You Need to Do:

- Reach Out to Your Lender: Start the conversation ASAP. Forbearance isn’t automatic, so you need to apply.

- Ask Questions: Find out what happens after the forbearance period—like repayment plans or loan extensions.

- Make a Plan: Use this time to figure out how you’ll get back on track financially.

Forbearance Is Here to Help

Nobody wants to face financial challenges, but knowing your options can make all the difference. Mortgage forbearance is a powerful tool for keeping your home secure during tough times.

If you or someone you know could use a little help, don’t hesitate. Reach out to your lender, ask about forbearance, and explore your options. Remember, you’re not alone—solutions are out there, and this one could make all the difference.

Anytime between “now” and “right now” is a good time to take action on shaping your best life, and that includes where you live. Let’s get the ball rolling on your next steps.

(702) 374-6807. Or drop me a line here.