Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? Maybe you’re thinking about dipping into your 401(k) to buy a home? Ah, the temptation! But before you break open that piggy bank and start raiding your retirement savings, let’s take a step back and explore some alternative financing options. Trust me, your future self will thank you.

The Numbers May Make It Tempting

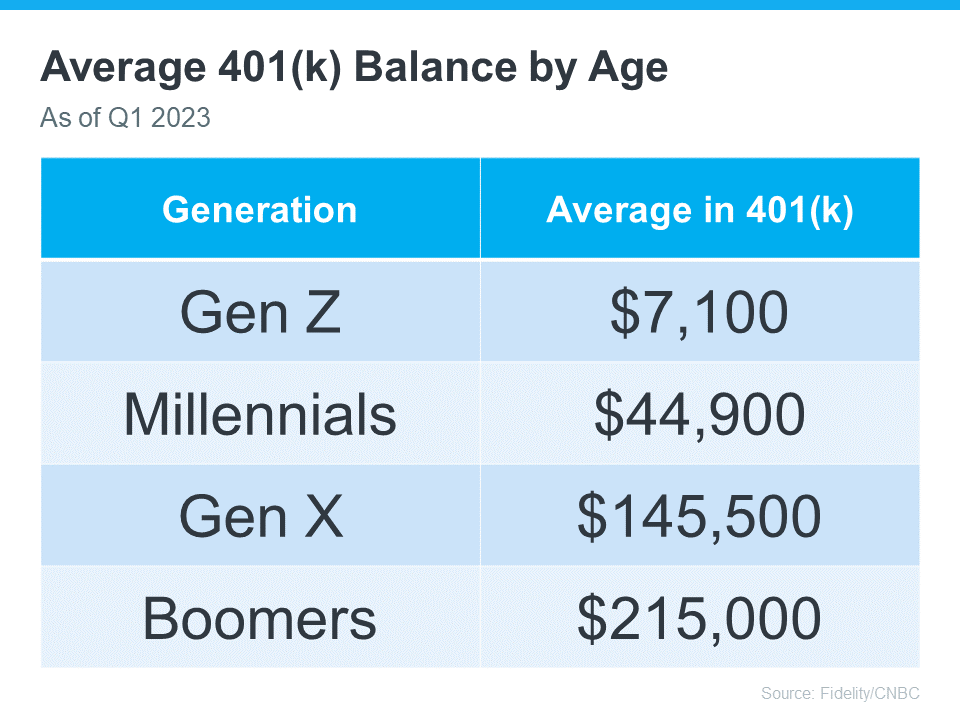

The data shows many Americans have saved a considerable amount for retirement (see chart below):

When times are tight and prices are high (hello world!), it can be really tempting when you have a lot of money saved up in your 401(k). With stars in your eyes, you see your dream home on the horizon. So pretty and within reach. But remember (cue record scratch), dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home.

Alternative Ways To Buy a Home

While it may be tempting to tap into that sweet 401(k) fund, it’s important to have a plan in place. Sure, buying a home is exciting, but we don’t want to leave our golden years high and dry. Instead of depleting your retirement savings, consider exploring other avenues like low-interest mortgages or down payment assistance programs.

Remember, the key here is having a plan. Don’t let the allure of homeownership cloud your judgment. Take the time to weigh out all your options and consult with financial experts who can guide you through this maze of decisions.

Bottom Line

Because hey, wouldn’t it be great if we could have our dream home without sacrificing our golden years? Let’s think smart and keep those retirement dreams alive while still making our homeowner dreams come true! If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

Anytime between “now” and “right now” is a good time to take action on shaping your best life, and that includes where you live. Let’s get the ball rolling on your next steps.

(702) 374-6807. Or drop me a line here.