So, you’re wondering—should you buy a home now or wait? It’s a big decision, and there’s a lot to think about. Maybe you’re hoping interest rates will drop. Maybe you’re crossing your fingers for home prices to take a dip.

But here’s the thing: trying to “time the market” is like trying to predict the winning lottery numbers. Even the experts don’t have a crystal ball! That’s why real estate pros always say: Time in the market beats timing the market.

Translation? If you’re ready to buy a home and the numbers make sense, jump in sooner rather than later.

Why Buying Now Just Makes Sense

Let’s break it down. The longer you wait, the more you might end up paying. Even if home prices aren’t skyrocketing like they were a couple of years ago, they’re still going up.

No matter what’s happening in the real estate market—whether home prices are rising or interest rates are shifting—buying a home now allows you to start building equity immediately. Instead of waiting for the “perfect” time, homeowners who buy sooner rather than later can begin growing their wealth through home appreciation and mortgage payments, while renters continue paying into someone else’s investment.

And equity = wealth. Every mortgage payment you make is an investment in your future—not your landlord’s.

The Numbers Don’t Lie—Home Prices Are Going Up

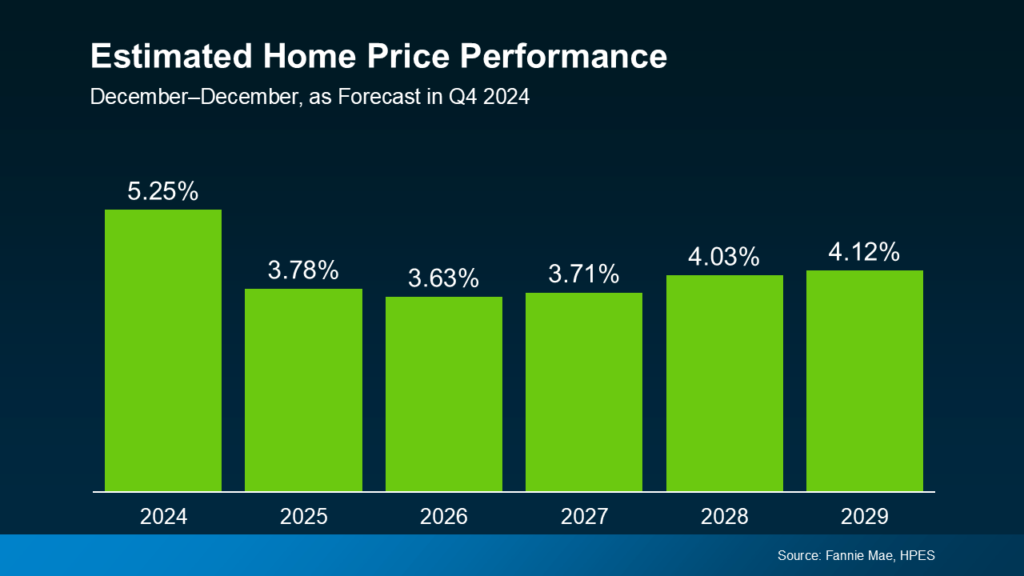

Each quarter, Fannie Mae surveys top economists, real estate experts, and market analysts to see where home prices are headed. And guess what? The latest Home Price Expectations Survey (HPES) predicts that home prices will keep rising through at least 2029—just at a more normal pace than the crazy spikes we’ve seen in the past few years.

What does that mean for you? Let’s look at an example:

If You Buy a $400,000 Home in Early 2025…

🏡 2025: $400,000

📈 2026: $420,000

💰 2027: $441,000

🚀 2028: $462,050

🎉 2029: $483,152

That’s over $83,000 in wealth built up in just five years!

Now, let’s compare that to renting:

- Monthly rent? Gone.

- Equity growth? Zero.

- Financial gains? Nada.

Waiting doesn’t mean you’ll save money—it just means you’ll probably pay more later for the same house.

“But What If I’m Not Quite Ready?”

I hear you! If today’s market feels a little intimidating, let’s get creative:

Look at more affordable areas – Expanding your search can uncover hidden gems!

Consider condos or townhomes – You’ll still build equity, just with a lower price tag!

Check out down payment assistance programs – You might qualify for help without even realizing it!

The bottom line? Waiting won’t make buying easier—it just means missing out on potential equity.

Let’s Make It Happen!

If you’re on the fence about buying now or waiting, remember: time in the market beats timing the market. Let’s chat and figure out a game plan that works for you!

📞 Call, text, or DM me today—let’s turn those homeownership dreams into reality!

Anytime between “now” and “right now” is a good time to take action on shaping your best life, and that includes where you live. Let’s get the ball rolling on your next steps.

(702) 374-6807. Or drop me a line here.