Hello Baby Boomers! Perhaps your current home is feeling a bit stale — you’ve lived there a while and are ready to make a change. What are your options? You can move just down the street, to a different state, downsize, or move to be near loved ones. Whatever amazing adventure you embark upon, one question remains — should baby boomers buy or rent their next home? Like selecting a pair of shoes, your choice depends upon your future plans. Let’s look at two factors to help you decide, so you aren’t caught wearing flip flops in sub-zero temperatures.

Expect Rents to Keep Going Up

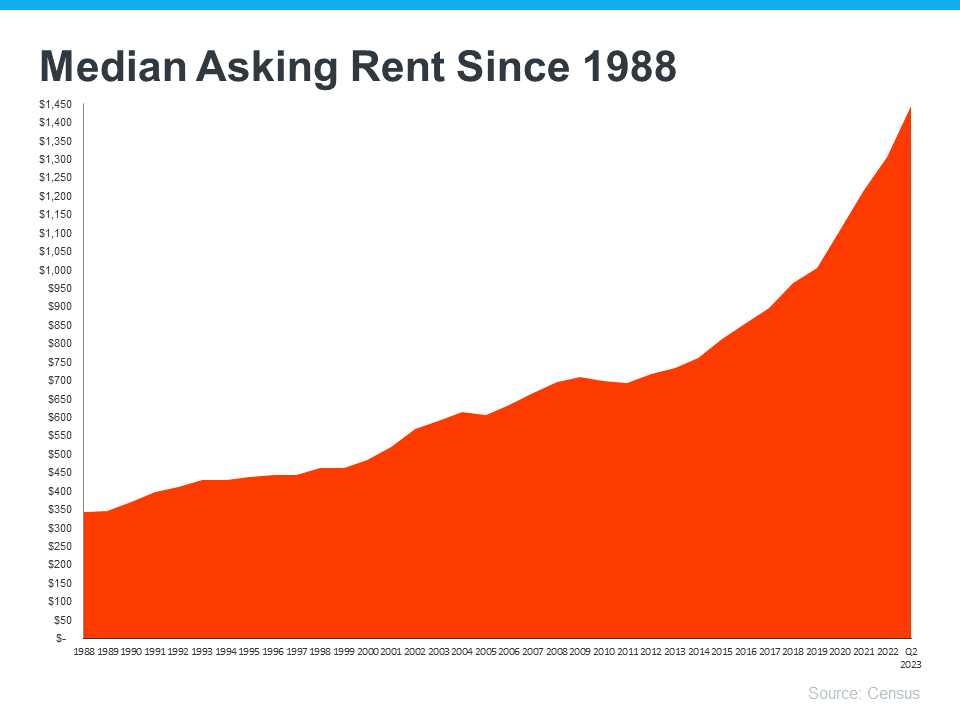

I’m going to be real honest with you all, rent will only continue to rise over time, even though we wish it wouldn’t. Maybe if we all wish really really hard? The graph below uses data from the Census to show how rents have been climbing steadily since 1988 (anyone up for some time travel for that amazing $350 median rent?):

That’s a steep mountain to scale, friends! If after you sell your home, you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year. Unexpected expenses are no fun, all.

On the other hand, when you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Three cheers for consistency!

Owning Your Home Comes with Unique Benefits

Benefits are always a plus! According to a recent report, buying your next home gives you all kinds of long-term benes. Let’s explore them, shall we?

- Owning your home can help you save money for the future. Always a good thing, right? Your home, and the equity you build as a homeowner, can provide generational wealth that could be passed on to loved ones, giving them a better life.

- You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright (congrats if that’s the case!), you wouldn’t have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

- Aging in place can be simpler. If your needs change, owning your home gives you the freedom to make renovations and updates that can make everyday life easier.

Bottom Line

Should baby boomers buy or rent? If you’re a baby boomer who’s weighing the choices of your next move, let’s connect. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home.

Anytime between “now” and “right now” is a good time to take action on shaping your best life, and that includes where you live. Let’s get the ball rolling on your next steps.

(702) 374-6807. Or drop me a line here.